Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Learn the methodologies, frameworks, and tricks used by Management Consultants to create executive presentations in the business world.

Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Transformation of an organization into a Next-generation Learning Organization (NLO) is a challenging endeavor. The main hurdles include convoluted hierarchies, bureaucratic red tape, delayed decision making, and complicated organizational systems and processes.

Transformation of an organization into a Next-generation Learning Organization (NLO) is a challenging endeavor. The main hurdles include convoluted hierarchies, bureaucratic red tape, delayed decision making, and complicated organizational systems and processes.

To develop a learning organization, leadership needs to trim down bureaucracy and complexities. They should make the best use of technology to gather holistic real-time data, deploy Artificial Intelligence at scale, and develop data-driven decision-making systems.

Five Core Pillars of Learning are essential for the creation of a Next-generation Learning Organization, including:

Let’s take a deep dive into the first 3 Core Pillars.

The first pillar is Digital Transformation. Next-generation Learning Organizations (NLOs) are characterized by their speed of learning and their adeptness to take action based on new insights. They use emerging technologies to automate as well as “autonomize” their businesses, without relying too much on human intervention and decision-making.

By autonomizing, the NLOs enable machines to learn, take action, and evolve on their own based on continuous feedback. They create integrated learning loops where information flows automatically from digital platforms into AI algorithms where it is mined in run-time to gather new insights. The insights are passed to action systems for necessary action that create more data, which is again mined by AI, and the cycle continues, facilitating learning at fast pace.

Next-generation Learning Organizations (NLOs) schedule time for their people to have unstructured reflection on their work. While most organizations fear disruption of human work in future by AI and machines, NLOs assign unique roles to their people based on human cognition strengths—e.g., understanding relationships, drawing causal judgment, counterfactual thinking, and creativity. These organizations are aware of AI’s advantage—in analyzing correlations in complex data promptly—as well as its shortcomings in terms of reasoning abilities and interpretation of social / economic trends. NLOs make design the center of their attention and utilize human creativity and imagination to generate new ideas and produce novel products. They assign roles accordingly, inspire imagination in people by exposing them to unfamiliar information, and inculcate dynamic collaboration.

NLOs foster innovative ways to promote collaboration between people and machines. They recognize that this helps them in better utilization of resources, maximize synergies, and learn dynamically.

To create effective collaboration between people and machines, NLOs develop robust human-machine interfaces. The existing AI systems lack the ability to decipher everything, which is an area where humans excel. NLOs supplement these shortcomings by setting up human-machine interfaces, where humans assist the AI by corroborating its actions and suggesting sound recommendations. These learning organizations bifurcate responsibilities based on the risks involved, assign humans and machines appropriately against each job, and select a suitable level of generalization and sophistication between humans and machines.

Interested in learning more about the Core Pillars of Learning? You can download an editable PowerPoint on Next-generation Learning Organization: Core Pillars here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Gordon Moore, Intel co-founder, observed that the number of transistors in a dense integrated circuit doubles about every two years. He projected that this rate of growth would continue for at least another decade.

Gordon Moore, Intel co-founder, observed that the number of transistors in a dense integrated circuit doubles about every two years. He projected that this rate of growth would continue for at least another decade.

His observation, termed the “Moore’s Law,” has correctly predicted the pace of innovation for several decades and guided strategic planning and research and development in the semiconductor industry. Moore’s law is based on observation and projection of historical trends.

In 2015, Gordon Moore foresaw that the rate of progress would reach saturation. In fact, semiconductor advancement has declined industry-wide since 2010, much lower than the pace predicted by Moore’s law. The doubling time and semi-conductor performance has changed, but it has not impacted the nature of the law much.

Although many people predict the demise of Moore’s law, exponential growth in computing power persists with the emergence of innovative technologies. Moore’s law is only part of the equation for effective Digital Transformation—there are other contributing factors including the role of leadership.

George Westerman—a senior lecturer at the MIT Sloan School of Management—proposes a new law, which states that, “Technology changes quickly, but organizations change much more slowly.” The law known as the “First Law of Digital Transformation” or “George’s Law” is a pretty straightforward observation, but is often ignored by the senior leadership. This is why Digital Transformation is considered more of a leadership—than technical—issue.

Just announcing an organization-wide Transformation program does not change the enterprise. According to George’s Law, successful Digital Transformation hinges on the abilities of senior leadership to effectively manage the so many contrasting mindsets of its workforce, identify and take care of the idiosyncrasies associated with these mindsets, interpret their desires, and focus attention on encouraging people to change.

Above all, the leadership should focus on converting Digital Transformation from a project to a critical capability. This can be done by shifting emphasis from making a limited investment to establishing a sustainable culture of Digital Innovation Factory that concentrates on 3 core elements:

Let’s now discuss the first 2 elements of the First Law of Digital Transformation.

Without a clear and compelling transformative vision, organizations cannot gather people to support the change agenda. People can be either change resisters, bystanders, or change enablers. However, most people typically tend to like maintaining the status quo, ignore change, or choose to openly or covertly engage in a battle against it.

For the employees to embrace change, leadership needs to make them understand what’s in it for them during the transition and the future organizational state. This necessitates the leaders to develop and share a compelling vision to help the people understand the rationale for change, make people visualize the positive outcomes they can achieve through Transformation, and what they can do to enable change. A compelling vision even urges the people to recommend methods to turn the vision into reality.

Problems and shortcomings in the legacy platforms is an important area to focus on during Digital Transformation. The legacy technology infrastructure, outdated systems, unorganized processes, and messy data are the main reasons for organizational lethargy. These issues hinder the availability of a unified view of the customer, implementing data analytics, and add to significant costs in the way of executing Digital Transformation.

Successful Digital Innovation necessitates the organizations to invest in streamlining the legacy systems and setting up new technology platforms that are able to enable digital and link the legacy systems. Fixing legacy platforms engenders leaner and faster business processes and helps in maintaining a steady momentum of Innovation.

Interested in learning more about the First Law of Digital Transformation? You can download an editable PowerPoint on First Law of Digital Transformation here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Technology, Internet, growth, and globalization have metamorphosed the way we work, play, and live. They have even changed the fundamental laws of economics. We are living in an economy that is quite different from the old manufacturing-based economy of the 1980s. Fewer people are now employed in the manufacturing sector, who are anxious about the prospects of being replaced by machines soon.

The “New Economy” is a term economists started using in the 1990s to describe new, high-tech, high-growth industries that have been the driving force of economic growth since that period. The new economy is also heralded as the Digital Economy, the Knowledge Economy, the Data Economy, or the eCommerce Economy. Top technology enterprises—including Google, Facebook and Apple—have outpaced traditional firms around the globe by taking advantage of the new economy.

Leadership Development in this age of Digital Economy is a key challenge for most organizations. More and more organizations, today, are revisiting what they are about and the meaning of leadership for them. It’s not about one person or even those residing at the top anymore.

MIT Sloan Management Review conducted a study of 4,000 executives from 120 geographies around the world to understand what defines a great leader in this changing world. The study revealed striking results with most executives believed that their leaders lacked the mindset needed to produce the strategic changes essential for leading in the Digital Economy. Enterprise-level transformation is what majority of leaders feared to embark on.

Mindsets are established set of attitudes held by someone that shape how a person interprets and responds to experiences. A mindset arises out of a person’s view of the world or philosophy of life. To know about the Digital Economy leadership mindsets (i.e. leadership mindsets critical to survive in this new economy), the MIT Sloan Management Review’s global study identifies 4 critical mindsets—based on in-depth interviews from executives worldwide and detailed analysis of data:

Let’s define these first 2 leadership mindsets.

Leaders with a producer mindset evaluate each of their customer touch points painstakingly. These leaders exhibit a passion for producing customer value. Producers concentrate on analytics, digital know-how, implementation, results, and customer satisfaction. They focus on analytics to fast-track creativity. The resulting innovation helps them tackle shifting customer preferences and enhance customer experiences. The Producers strive to create all the customer journeys enjoyable.

The leaders with an investor mindset make people appreciate the higher purpose they serve by their work. They constantly struggle to instill motivation and teamwork among their teams in order to achieve their overall organizational goals. The leaders with an investor mindset are concerned about the communities that surround them. They look after the well-being and constant advancement of their employees, and devote their efforts to improve value for their customers.

Fostering these types of mindsets is critical to building the right Organizational Culture for an organization to be successful in the Digital Economy.

Interested in learning more about the leadership mindsets required to win in the new economy? You can download an editable PowerPoint on Leadership Mindsets Critical to Succeed in the Digital Economy here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Disruptive technologies are helping companies automate work. Robotic Process Automation and Artificial Intelligence are taking up jobs which were in the past earmarked only for smart humans. Driver-less cars, automated check-in kiosks at airports, and autopilots steering the aircrafts are just few instances of how automation is transforming our world.

Disruptive technologies are helping companies automate work. Robotic Process Automation and Artificial Intelligence are taking up jobs which were in the past earmarked only for smart humans. Driver-less cars, automated check-in kiosks at airports, and autopilots steering the aircrafts are just few instances of how automation is transforming our world.

However, automation presents unique challenges that organizations need to identify and mitigate appropriately. These include costs associated with job losses; confidentiality of data; quality and safety risks stemming from automated processes; and regulatory implications.

Other critical factors to consider before investing in automation are adoption, pace of development of automation, and readiness of organizational leadership in redefining processes and roles to support automation.

The key question is how automation will impact our work in future. Should we anticipate benefits — e.g., efficiency gains and quality of life improvements — or dread further disruption of established business and job cuts?

Research by McKinsey suggests that Robotic Process Automation will impact 4 workplace areas the most:

Now, let’s discuss the first two key areas in further detail.

Research findings (based on the US labor market data) reveal that the future does not likely hold complete automation of individual jobs, but rather automation of certain activities within specific occupations. The assumption that only routine, codifiable activities can be easily automated — and those that necessitate implicit knowledge will be unaffected — is misleading. Automation has already reached (or surpassed) the median level of human performance in some cases.

Capital or hardware-intensive industries — under stringent regulatory control — are slow and expensive to automate and need more time to reap return on investments. Whereas, the sectors where automation is mostly software based (e.g., financial services) may create value at a far lower cost and within rather shorter span of time.

The current level of automation can potentially transform a number of occupations to a certain level, but it requires redefinition of job roles and activities. Research reveals that only about 5% of occupations can be completely automated with the current level of technology.

In spite of this, automation can boost human productivity even in the highest paid occupations by taking care of repetitive daily tasks — e.g., analyzing paperwork, reports, data and evaluating applications based on criteria — and freeing up time for people to focus more on high value work that involves human emotions and creativity.

For instance, Automation and Machine Learning can automate diagnosis of common ailments, thereby enabling the doctors to concentrate more on acute or complicated problems. Likewise, lawyers can employ data mining tools to sift through piles of documentation to isolate the most relevant cases for their review.

Interested in learning more about the other key areas most impacted by Robotic Process Automation? You can download an editable PowerPoint on Impact of Robotic Process Automation here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Corporate Social Responsibility (CSR) is an organization’s commitment to produce an overall positive impact on society. CSR encompasses sustainability, social and economic impact, and business ethics. It makes a company socially accountable of its operations, stakeholders, and the public. Businesses undertake CSR programs to benefit society while boosting their own brands.

CSR affects every aspect of business operations and functions. Encouraging equal opportunities; partnering with organizations practicing ethical business methods; putting part of earnings back into environment, health, and safety initiatives; and taking care of communities and charity are all examples of CSR initiatives.

Communities, customers, employees, and media consider CSR vital and gauge companies based on these initiatives. Executives of leading companies consider CSR as an opportunity to deal with critical issues innovatively, reinforce their organizations, and serve the society simultaneously.

Organizations need to come up with a robust approach to unlock potential benefits and value from CSR for them and for the society. The organizations practicing Corporate Social Responsibility do that with one of the following 4 objectives in mind:

Among these objectives, Smart Partnering offers maximum opportunities for shared value creation and finding solutions to crucial business and social challenges. Whereas for the society, smart partnering helps create more employment opportunities, improve livelihoods, and enhance the quality of life.

An effective way for the companies to maximize benefits of their CSR efforts is to map the current initiatives; identify the objectives, benefits, and resources responsible for realizing value from those initiatives; and define the projects valuable for addressing key strategic challenges.

Pet projects, philanthropy, or propaganda are easy to plan and execute. However, the real issue is to implement CSR opportunities that bring value for the business as well as society (smart partnering). This goal can be achieved by applying these 3 guiding principles:

Real opportunities lie in the segments where the business collaborates with and influences the society the most. These segments help the business interpret mutual dependencies and uncover maximum mutual benefit.

After finalizing the opportunity segments, it is imperative to appreciate the potential for mutual benefit. The key is to find the right balance between the business and community and recognize the challenges that both sides face.

Collaboration with right partners—who benefit from business endeavors and capabilities of each other—creates a win–win situation for both sides and motivates them to achieve mutual value. Sustainable collaboration demands long-term alliances and deeper insights on the strengths of each other.

These principles are helpful in selecting appropriate CSR opportunities, identifying societal and business needs to be addressed, and the required resources and capabilities.

The goal of unlocking mutual benefits—associated with CSR (specifically Smart Partnering)—is critical for long-term success of the program. As required by any other strategic initiative, the mutual value creation objective needs to be carefully assessed based on the true value-creation potential, prioritized, designed, staffed, and audited.

The next step is to outline the list of potential benefits for the business and community. A well-defined business case and a compelling story immensely helps involve and gain commitment from the senior leadership, investors, and employees.

Interested in learning more about how to tap CSR opportunities effectively? You can download an editable PowerPoint on Corporate Social Responsibility (CSR) Opportunities here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

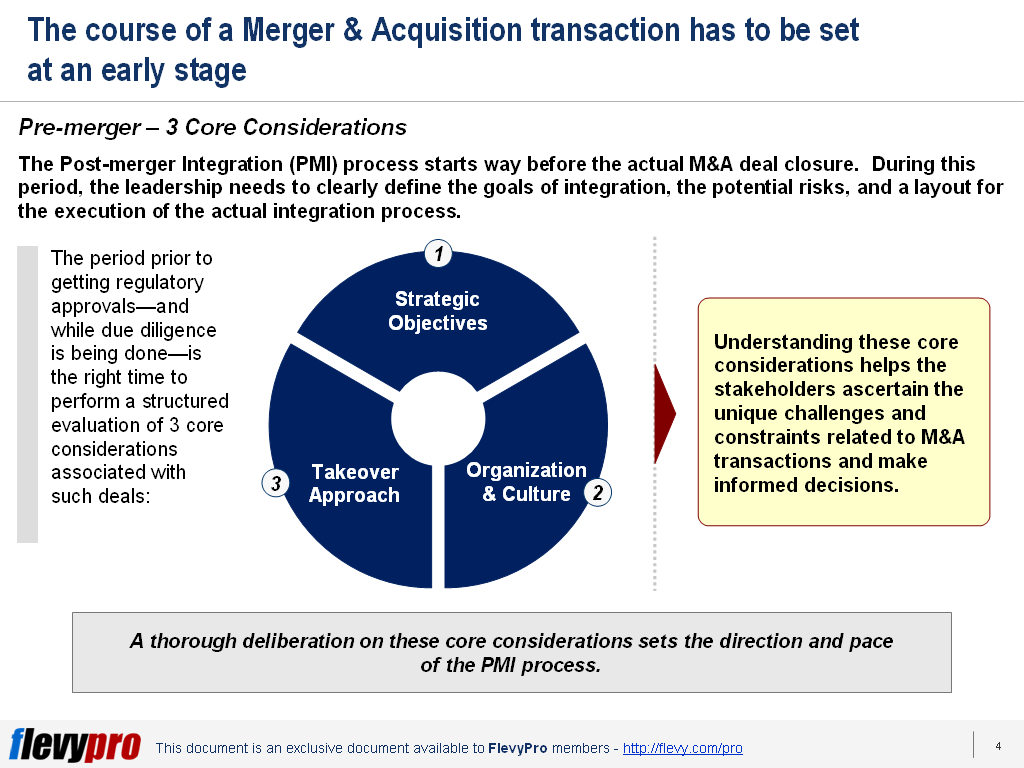

The course of an M&A transaction has to be set at an early stage, way before the actual deal closure. The period prior to the deal approval by the regulatory authorities and while due diligence is being done is most critical, and should be utilized by the leadership to clearly define the goals of integration, the potential risks, and a layout for the execution of the actual integration process. It is the right time to perform a structured evaluation of 3 core pre-merger considerations associated with such deals, i.e.:

Understanding these PMI Pre-merger considerations helps the stakeholders ascertain the unique challenges and constraints related to M&A transactions and make informed decisions. These considerations assist in developing a systematic approach to undertaking a Post-merger Integration (PMI) — which is devoid of any “gut decisions,” and ensures realization of synergies and value. These considerations set the direction and pace of the post-merger integration process.

Now, let’s discuss the 3 core considerations in detail.

Organizations undertake Mergers and Acquisitions as a way to accelerate their growth rather than growing organically. The foremost core consideration associated with an M&A transaction is the strategic objectives that the organizational leadership wants to achieve out of it.

M&A deals take place to fulfill one or more of these 5 strategic objectives:

The PMI approach needs to be tailored in accordance with the desired strategic objectives of the deal.

The senior management should be mindful of the significance of organizational and cultural differences in the two organizations that often become barriers to M&A deals. Small companies, typically, have an entrepreneurial outlook and culture where there aren’t any formal structure and the owner controls (and relays) all the information and decision making. Whereas, large corporations typically have formal structures and well-defined procedures.

A takeover of a small firm by a large entity is bound to stir criticism and disagreement. M&A process often faces long delays between the offer, deal signing, and closing — due to antitrust reviews or management’s indecisiveness — triggering suspicion among people. This should be mitigated during the PMI process by orienting the people of the small firm with the new culture and giving them time to transition effectively.

For M&A deals to be effective, leadership needs to carefully evaluate the behavioral elements of the organizational culture and contemplate the overriding principles guiding a company.

Integrating the operations of two companies proves to be a much more difficult task in practice than it seems theoretically. Organizations have the option of selecting the takeover approach most suitable for them from the following 4 methodologies — based on their organizational structures, people, management, processes, and culture:

Interesting in learning more about the takeover approach and the pre-merger considerations in detail? You can download an editable PowerPoint on Post-merger Integration: Pre-merger Considerations here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—Mergers and Acquisitions. However, only a few M&As achieve their desired revenue objectives.

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—Mergers and Acquisitions. However, only a few M&As achieve their desired revenue objectives.

Revenue Synergies are a decisive factor in closing such deals. However, identifying precisely where these Revenue Synergies lie and then capturing them isn’t as easy as it sounds.

A McKinsey study comprising of 200 M&A executives from 10 different sectors revealed that all the respective organizations of the respondents remained short of achieving their Revenue Synergy targets (~23% short of the target on average). Securing Revenue Synergies is a long-term game. The companies that succeed in securing Revenue Synergies achieve the target in or around 5 years.

Leaders aspiring to achieve Revenue Synergies should first clarify the objectives from and the schedule of the revenue synergies, lay out the organizational priorities and go-to-market strategies, remove obstacles from realizing value, and gain across the board readiness and commitment for the initiative. Organizations that are most successful in securing revenue synergies pay close attention to these 7 guiding principles during the Post-merger Integration process:

These 7 guiding principles to capturing Revenue Synergies are critical for effective integration of two firms after a merger and unlocking potential benefits from the deal. Let’s discuss the first 3 principles in detail now.

The inability of the leadership of the acquiring company to spot major sources of revenue that integration brings in results in losing significant pools of opportunity and failure of M&As. Realizing Revenue Synergies demands a thorough methodology to ascertain and qualify revenue prospects along markets and channels, Go-to-Market Strategies, and developing commercial capabilities. This entails:

Organizations that accomplish their Revenue Synergy objectives guarantee that their top management and employees commit themselves fully to the initiative from the onset. They identify potential value pockets from the integration, examine the assumptions about securing value, and get them endorsed by the senior management and front-line staff. The potential Revenue Strategies are regularly evaluated by inter-departmental experts.

Accurate estimation of Revenue Synergies demands top-level estimates—assumptions on market share gain, revenue enhancement, or improved penetration—alongside comprehensive bottom-up customer insights, and evaluation of customer relationships. Other important elements to consider include analyzing the offerings being offered to customers, discerning other potential products and services required by the customers, and assessing the ability of the sales team and brands in terms of the potential they offer to the clients.

Interested in learning more about the other guiding principles of securing PMI revenue synergies? You can download an editable PowerPoint on Post-merger Integration (PMI): Securing Revenue Synergies here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Here is a compilation of the free PowerPoint documents we’ve made available through the course of 2011.

Holiday Gift PowerPoint Toolkit

http://learnppt.com/downloads/holiday-gift/

Here is a collection of 20+ PowerPoint diagrams, templates, and charts, originally created as a holiday gift to LearnPPT’s newsletter subscribers.

Process Optimization Presentation

http://learnppt.com/downloads/process-optimization/

This is a process optimization presentation. It is the accompanying download for this PowerPoint tutorial:

http://powerpointing-templates.com/2011/10/slide-from-scratch-process-optimization-presentation/

Business Strategy Update Presentation

http://learnppt.com/downloads/strategy-update/

This is a presentation showing a business strategy update. It is the accompanying download for this PowerPoint tutorial:

http://powerpointing-templates.com/2011/09/business-strategy-update-presentation/

Agenda and Transition Slide Template

http://learnppt.com/downloads/agenda-contents/

This is a simple, clean, table-based template used for creating the agenda slide and transition slides.

Cone Diagrams

http://learnppt.com/downloads/cone_diagrams/

This is a set of cone diagrams. Creating a cone diagram yourself is simple, as illustrated by the accompanying tutorial:

http://powerpointing-templates.com/2011/06/powerpointing-how-to-create-a-cone-diagram/

Decision Tree Template

http://learnppt.com/downloads/decision-tree-powerpoint-template/

This is a fancy looking decision tree diagram/template. It was created originally for a client slide that was scrapped. You can modify it to include additional decision points and outcomes.

Diamond Diagram

http://learnppt.com/downloads/diamonds/

This is a set of diamond diagrams of various segments. It is created using the built-in Radar charts, as illustrated in the accompanying tutorial:

http://powerpointing-templates.com/2011/02/powerpointing-how-to-create-a-diamond-diagram/

Want to add more free PowerPoints to your collection? Check out our free PowerPoint downloads of 2010 (26 in all last year):

http://powerpointing-templates.com/2010/12/free-powerpoint-downloads-of-2010/

Thanks for reading our blog!

Questions, thoughts, concerns? Go to my site (learnppt.com) and shoot me an email.

For pre-made PowerPoint diagrams used in business presentations and other powerpointing needs, browse our library here: learnppt.com/powerpoint/. These diagrams were professionally designed by management consultants. Give your presentations the look and feel of a final product made by McKinsey, BCG, Bain, Booz Allen, Deloitte, or any of the top consulting firms.

One of the easiest diagrams to create is the Cone Diagram. In fact, it’s just the piecing together of 2 shapes: a triangle (for the body) and a circle (for the opening). Just see below.

To enhance the look of the circular opening, I like to change the background color fill of the circle using a linear gradient.

Similar to the PowerPoint funnel diagram, a cone diagram is a great tool to illustrate a downselection or filtering down process. Likewise, you can also easily build upon the cone diagram to show added layers and direction of flow. See the examples below.

You can download all the cone diagrams shown in this PowerPoint tutorial here (http://learnppt.com/downloads/cone_diagrams/). Enjoy.

You can also download a free PowerPoint plugin called Flevy Tools that creates commonly used consulting diagrams: http://flevy.com/powerpoint-plugin. Flevy Tools allows you to dynamically generate Gantt Charts, Harvey Ball diagrams, approach diagrams, and other diagrams. For the time being, it’s a completely free download.

Questions, thoughts, concerns? Go to my site (learnppt.com) and shoot me an email.

For pre-made PowerPoint templates used in business presentations, browse our library here: learnppt.com/powerpoint/. These diagrams were professionally designed by management consultants. Give your presentations the look and feel of a final product made by McKinsey, BCG, Bain, Booz Allen, Deloitte, or any of the top consulting firms.

Through this Sunday, learnPPT is having a promo for the Cost Reduction Toolkit. This detailed document identifies over 45+ cost cutting initiatives across the Value Chain. For each initiative, examples are provided, along with projected potential savings.

The Cost Management opportunities are broken down into the areas of:

This toolkit also explains the levers and challenges to profitability, as well as the formula identifying cost reduction opportunities.

Here’s a partial preview of the PowerPoint presentation.

Questions, thoughts, concerns? Go to my site (learnppt.com) and shoot me an email.

For pre-made PowerPoint diagrams used in business presentations and other powerpointing needs, browse our library here: learnppt.com/powerpoint/. These diagrams were professionally designed by management consultants. Give your presentations the look and feel of a final product made by McKinsey, BCG, Bain, Booz Allen, Deloitte, or any of the top consulting firms.

Error: Twitter did not respond. Please wait a few minutes and refresh this page.