Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Learn the methodologies, frameworks, and tricks used by Management Consultants to create executive presentations in the business world.

Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

The impact of the global pandemic, volatile stock markets, and slowed economic outlook across the globe has hurt the performance of enterprises across the world. The scenario has forced leaders to consider undertaking Transformation of their strategy and operations significantly.

The impact of the global pandemic, volatile stock markets, and slowed economic outlook across the globe has hurt the performance of enterprises across the world. The scenario has forced leaders to consider undertaking Transformation of their strategy and operations significantly.

The strategy to buy out troubled businesses and determining to fix the issues that upset the target companies has been a focus of Buyers’ senior leadership for the past 2 decades. In the year 2017 alone, 36,000 M&A (Mergers & Acquisitions) transactions were announced globally. Acquisition of troubled businesses hoping to have a Turnaround account for around 50% of all M&A deals.

A Turnaround can be defined as the financial recovery of an economy or an organization after a period of inertia or Downturn. Several issues trigger a Downturn—issues pertaining to technological disruption, regulations, processes, organization’s financial health, management, business model, hierarchy, or competition.

The ratio of success for M&As is, however, not very healthy. Historical data of 61% of M&A deals based on a BCG’s study, carried out on 1400 M&A deals globally between 2005 and 2018, shows a high failure rate (61%), where they remained unsuccessful to show any improvement in financial performance.

The ones that do succeed offer significant revenue growth and profit margins—around 25% positive variance in TSR than unsuccessful M&As. However, buying and fixing a business under the weather isn’t an easy job. This necessitates a meticulous strategy.

In order to materialize a Turnaround, the leadership needs to thoroughly understand the root cause(s) of the Downturn, have a willingness and plan to reform or transform, and rigorously implement the strategy to rectify the situation (Transformation Execution).

Empirical Research demonstrates that the triumph of M&A Turnaround deals is attributable to 6 Critical Success Factors:

Deployment of a combination of these CSFs bring about more pronounced outcomes—in terms of positive 3-year TSR and overall Organizational Performance.

A robust M&A Turnaround Strategy—based on lessons learnt from empirical research—revolves around 4 key M&A Deal Characteristics. These M&A deal characteristics have a profound impact on the outcome of the transaction:

Knowledge of these key Deal Characteristics allow the senior leadership to ascertain the factors liable to affect the deal outcomes. Now, let’s discuss the first 2 deal characteristics in a bit detail.

The performance of the Target company during 2 years pre-deal is a key point to consider for a M&A, as it is directly proportional to the deal success rate and Total Shareholder Return. BCG’s research demonstrates that M&A transactions where the target entity had a 2-year TSR decline of lower than 10% were liable to be more successful than deals where target companies were in more distress (a decline of ~30% or more).

Senior leaders should not ignore the significance of uniformity of sectors of the target and acquiring company. Based on research, the rate of success for an acquisition transaction involving the buyer and the target operating in the same industry is 5% superior to the rate for transactions involving the companies from different sectors. The reason for this higher success rate is attributed predominantly to similar business models, customers, vendors, and processes in firms of the same sector, which make the Post-merger Integration of the buyer and target a lot easier.

Interested in learning more about the other characteristics influencing the outcome of an M&A deal? You can download an editable PowerPoint presentation on M&A Turnaround Strategy here on the Flevy documents marketplace.

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“As a small business owner, the resource material available from FlevyPro has proven to be invaluable. The ability to search for material on demand based our project events and client requirements was great for me and proved very beneficial to my clients. Importantly, being able to easily edit and tailor the material for specific purposes helped us to make presentations, knowledge sharing, and toolkit development, which formed part of the overall program collateral. While FlevyPro contains resource material that any consultancy, project or delivery firm must have, it is an essential part of a small firm or independent consultant’s toolbox.”

– Michael Duff, Managing Director at Change Strategy (UK)

A significant number of Mergers remain unsuccessful, because companies do not employ a thorough and disciplined approach to realizing Post-Merger Integration Synergies. In reasons for failure, we hear remarks like:

A disciplined and rational approach to pursuing Merger Synergies is key to successful Post-Merger Integration (PMI). Companies that authenticate and set pragmatic yet ambitious Post-Merger Integration Synergy targets do the following to exceed targets and achieve substantial share price premium and a significant Competitive Advantage:

Successful PMI Synergies—be it in Cost Optimization, Strategic Sourcing, Greater Revenues or any other Cost or Revenue realm—have the common characteristic of leaders pursuing synergies with speed, rigor, discipline, and pragmatism with lots of analysis, planning, preparation, and fine-tuning before the close.

Success can be ensured time and again if the 6 Strategies for Post-Merger Integration Synergies are followed to the letter:

Implementation of the 6 Synergy Strategies involves adopting High-Engagement and Rapid Iteration approach which yields effective Stretch Target Validation and High Level of Line Accountability.

Let us delve a little deeper into 2 of these PMI Synergy Strategies.

Linking DD to PMI ensures realistic estimates on part of the DD team thus avoiding formulation of broad-brushed and imprecise Synergies. Linking also guarantees greater amount of ownership and accountability at the same time enabling more compelling Stretch Targets. Linking of DD to PMI is necessary because:

Successful Mergers ensure a harmonized hand-off from Due Diligence teams to Integration Planning teams by ensuring the following:

Clean team is an independent group that is tasked with the collection and analysis of sensitive company data—pre-closure—with the guidance of management. Clean team may comprise of third-party members or employees who can be reassigned out of business in case of deal failure eradicating the risk of compromising confidential information. Clean team is formed by legal contract based on protocols agreed to by both company’s legal departments. Clean teams help by:

Interested in learning more about the 6 Strategies for Post-Merger Integration Synergies? You can download an editable PowerPoint on Post-Merger Integration (PMI): 6 Strategies for Synergies here on the Flevy documents marketplace.

Gain the knowledge and develop the expertise to become an expert in Post-merger Integration (PMI). Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

M&A is an extremely common strategy for growth. M&A transactions always look great on paper. This is why the buyer typically pays a 10-35% premium over the of the target company’s market value.

However, when it comes time for the Post-merger Integration (PMI), are we really able to capture the expected value? Studies show only 20% of organizations capture projected revenue synergies and only 40% capture cost synergies. Not to mention, the PMI process is typically very painful, drawn out, and politically charged, often resulting in the loss of key personnel.

Learn about our Post-merger Integration (PMI) Best Practice Frameworks here.

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd

Post-merger Integration is a highly complex process. It requires swift action as well as running the core business activities simultaneously. There is no one-size-fits- all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

Because of the complexity of the PMI process, it is of utmost importance that organizations—both the Buyer and Target, the integration team, and integration manager—have a guide that will provide them the detailed requirements of the process. The Post-merger integration framework has a structured approach that can direct attention to important integration areas to maximize deal value and achieve Operational Excellence. The inability to focus on priority areas can be a waste of resources, time, and investments.

The Post-merger Integration framework drives a structured approach to identify important Integration Areas to focus on during the transition. There are 12 Integration Areas that need to be prioritized.

The first 2 integration areas within the full checklist:

The next 2 integration areas within the full checklist:

The third 3 integration areas within the full checklist:

The last 5 PMI integration areas within the full checklist:

Organizations must take adept steps in undertaking the Integration Checklist as this will enable both the Buyer and the Target to reach the most strategic state necessary for the 12 Integration Areas.

Interested in gaining more understanding of the Post-merger Integration (PMI) Integration Checklist? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI) Integration Checklist here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Our framework Post-merger Integration (PMI): Financial integration is every organization’s guide to achieving the financial alignment of both Buyer and Target.

Post-merger Integration is a highly complex process. It requires swift action as well as running the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

Another critical factor in PMI is pursuing Financial Integration. Financial Integration is the alignment of the finance functions of the Buyer and Target.

Immediately from the start of the deal, the new organization gets to be dependent on the Finance function to ensure a successful integration process. Synergies must be captured in order to maximize deal value and provide combined organizations with the flexibility to grow.

When pursuing Financial Integration, there must be an integration of business operations, streamlining of the internal control environment, provision of accurate and consistent financial reporting, ensuring tax compliance jurisdictions if the deal is cross-border, and the founding of interim legal structure and business processes. When setting the right direction for a streamlined finance function, it is important that the organizations must already tackle critical matters while still in the early stages of a deal.

The establishment of clear reporting lines must already be agreed upon and set up. Accountability for financial operations, management reporting, control of expenses, and accounting closing procedures must already be established and clear between the Buyer and the Target. These play a vital role when the organization undertakes a Strategic Planning geared towards the development of a Financial Integration Strategy and Plan.

The Financial Integration Strategy can only be defined and crafted only when immediate areas that require action have already been identified. The Strategy must be developed based on 8 key areas of focus.

Aside from the 3 focus areas, the development of the PMI Financial Integration Strategic Plan must also give serious consideration on Financial Statements, Procurement, Financial Planning, Cash Controls, and Tax. These 5 focus areas are essentially important as it ensures that Financial Integration essentials are met.

When this is achieved and the 8 key areas of focus are integrated into the Financial Integration Plan, the new organization gets to prepare itself towards a larger scale Business Transformation in the future.

Interested in gaining more understanding of the Financial Integration component of PMI? You can learn more and download an editable PowerPoint about Post-merger (PMI): Financial Integration here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

When organizations go through a Post-merger Integration, often management realizes that it is never a simple undertaking. It is a highly complex process. Swift  action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.

action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.

The PMI Process requires a Strategy Development approach geared towards unifying 2 organizations into one new organization with a common culture, equipped with the right people and good leadership in place. It is a challenging journey where organizations, both the Buyer and the Target, must take on the appropriate approach to be able to start off the process and close the deal with the expected results in place.

New organizations often benchmark Post-merger Integration Process leaders to guide them through the process. By following best practices, new organizations will have a better understanding of how to approach the PMI process in a more strategic manner.

There are top 10 tips that can help organizations conquer what could be a complex integration process. Following the top 10 tips will enable organizations to successfully traverse through the process.

Let us discuss here 4 of the top 10 tips to achieve PMI success.

Aside from the 4 top tips, the other 6 top tips are equally effective in guiding organizations to achieve deal maximization. These top 10 tips can be of great help to organizations when faced with challenging obstacles as they go through the process of integration. The PMI Process is a very complex undertaking but it can be achieved and be conquered with just the right approach and guide.

Interested in gaining more understanding of Post-merger Integration (PMI): Tips for Success? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI): Tips for Success here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Post-merger Integration is a highly complex process. It requires swift action as well as running the core business activities simultaneously. There is no one-size-fits- all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

It is inevitable that some elements of information will be withheld from a Buyer pre-deal. Further, not all the synergy benefits originally identified in the deal will prove to be achievable. The foremost challenge for management at the onset of the PMI process is to identify how value can be captured from the newly combined organization via synergies and cost savings.

Post-merger Integration is the fundamental stage of realizing the value of an M&A deal. A highly complex process, it entails bringing together 2 companies experiencing change while ensuring that business continues as usual. A truly challenging undertaking that must never be underestimated.

When 2 companies agree to undertake a Post-merger Integration, its primary objective is to maximize synergies to ensure that the deal lives up to its predicted value. It is a phase during which the results of the Buyer’s M&A strategy and expectations for the closed deal start to materialize.

In the entire phase, Closing and Day One of change is the most critical. It is the initial starting point towards the change of ownership and where Strategy Development is at its core.

During Closing and Day One, Managers must focus on 3 important areas.

The CEO plays a vital role in the joint business. The CEO or Managing Director is involved in the acquisition process. Hence, it is important that from Day One, a CEO or Managing Director has already been appointed.

Often the CEO comes from the Buyer or its group or corporate entity. If an existing CEO of the acquired entity continues the same role, then the Buyer must nominate a controller to ensure financial integration and smooth reporting.

The Key Personnel is also essentially important from Day One. In fact, there is a need for positions and roles of key personnel during the integration process to be planned in advance and communicated at closing.

Interested in gaining more understanding of PMI Day One Activities? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI): Day One Activities here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

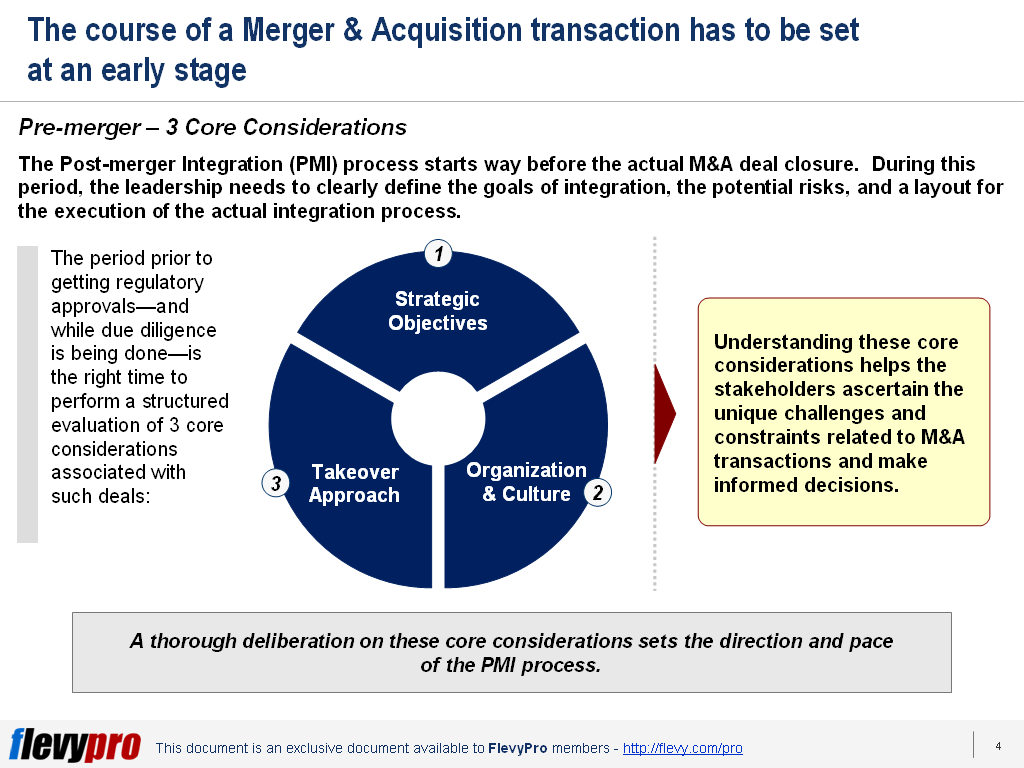

The course of an M&A transaction has to be set at an early stage, way before the actual deal closure. The period prior to the deal approval by the regulatory authorities and while due diligence is being done is most critical, and should be utilized by the leadership to clearly define the goals of integration, the potential risks, and a layout for the execution of the actual integration process. It is the right time to perform a structured evaluation of 3 core pre-merger considerations associated with such deals, i.e.:

Understanding these PMI Pre-merger considerations helps the stakeholders ascertain the unique challenges and constraints related to M&A transactions and make informed decisions. These considerations assist in developing a systematic approach to undertaking a Post-merger Integration (PMI) — which is devoid of any “gut decisions,” and ensures realization of synergies and value. These considerations set the direction and pace of the post-merger integration process.

Now, let’s discuss the 3 core considerations in detail.

Organizations undertake Mergers and Acquisitions as a way to accelerate their growth rather than growing organically. The foremost core consideration associated with an M&A transaction is the strategic objectives that the organizational leadership wants to achieve out of it.

M&A deals take place to fulfill one or more of these 5 strategic objectives:

The PMI approach needs to be tailored in accordance with the desired strategic objectives of the deal.

The senior management should be mindful of the significance of organizational and cultural differences in the two organizations that often become barriers to M&A deals. Small companies, typically, have an entrepreneurial outlook and culture where there aren’t any formal structure and the owner controls (and relays) all the information and decision making. Whereas, large corporations typically have formal structures and well-defined procedures.

A takeover of a small firm by a large entity is bound to stir criticism and disagreement. M&A process often faces long delays between the offer, deal signing, and closing — due to antitrust reviews or management’s indecisiveness — triggering suspicion among people. This should be mitigated during the PMI process by orienting the people of the small firm with the new culture and giving them time to transition effectively.

For M&A deals to be effective, leadership needs to carefully evaluate the behavioral elements of the organizational culture and contemplate the overriding principles guiding a company.

Integrating the operations of two companies proves to be a much more difficult task in practice than it seems theoretically. Organizations have the option of selecting the takeover approach most suitable for them from the following 4 methodologies — based on their organizational structures, people, management, processes, and culture:

Interesting in learning more about the takeover approach and the pre-merger considerations in detail? You can download an editable PowerPoint on Post-merger Integration: Pre-merger Considerations here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Mergers and Acquisitions (M&A) are unique and complex endeavors. These initiatives demand tailored solutions keeping in view the varying environments, ways of doing business, culture of the two combining organizations, and internal and external forces influencing the deal.

Mergers and Acquisitions (M&A) are unique and complex endeavors. These initiatives demand tailored solutions keeping in view the varying environments, ways of doing business, culture of the two combining organizations, and internal and external forces influencing the deal.

These transactions necessitate making 8 important decisions based on thorough deliberation and analysis of all relevant factors well before the integration process. These fundamental decisions and relevant factors form the 8 decision levers of Post-merger Integration (PMI). These 8 decision levers of PMI are essential for devising an optimal integration approach and, subsequently, the success of an M&A initiative:

These decision considerations facilitate Post-merger Integration across all industries and organizations of various sizes. Let’s discuss the first 3 decision levers in detail now.

The foremost element of a PMI is deciding on the type of synergy to be achieved through integration. The question is to either focus on achieving cost reduction or growth synergies. If cost cutting is the objective of an M&A then the leadership of the combined organization needs to outline potential costing saving opportunities across the board. This should be followed by robust communication strategy to convey the implications of the M&A program. However, if the management’s objective is to unlock growth synergies from the acquisition, then the integration is to be treated as a strategic endeavor—e.g., understanding the customer needs, evaluating market potential, generating innovative business ideas, and developing execution plans.

The 2nd lever demands from the senior leadership to determine the pace most appropriate for the integration of their newly combined enterprise—i.e., to choose between a fast track and a steadier integration approach. A majority of executives believe that PMI should be executed as quickly as possible, so that upon completion of the initiative they could divert their center of attention back to business operations. This approach, however, involves decisions that aren’t backed by detailed analysis of facts and data, and is likely to face increased risks and uncertainties. On the other hand, a slower pace of integration is beneficial in case of a friendly takeover or expansion in a new domain. A steadier pace of integration works well to reduce any apprehensions, cynicism, bottlenecks, and risks due to oversight.

PMI necessitates gauging the appropriate degree of integration beneficial for the organization—i.e., choosing between extensive across the board versus partial integration. An absolute focus on cost synergies warrants an extensive degree of integration across all departments and geographies. This puts extra pressure on teams in terms of work and risks dwindling enterprise focus on the customer. Committing more resources and setting the priorities right aids in offsetting the risks associated with an extensive degree of integration. A partial integration, on the other hand, is simpler, less controversial, and predominantly warrants consolidation of sales or alignment of mission-critical processes. This typically works well in takeovers requiring new products acquisition or addition of new customer segments.

Interested in learning more about the other 5 decision levers of PMI? You can download an editable PowerPoint on Post-merger Integration (PMI): 8 Levers here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Error: Twitter did not respond. Please wait a few minutes and refresh this page.