Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Learn the methodologies, frameworks, and tricks used by Management Consultants to create executive presentations in the business world.

Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Editor’s Note: If you are interested in becoming an expert on Post-merger Integration (PMI), take a look at Flevy’s Post-merger Integration (PMI) Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can stay ahead of the curve. Full details here.

* * * *

Mergers and Acquisitions (M&A) generally do not produce the outstanding results that they are envisioned and purported to provide. Some companies in certain industries, however, demonstrate consistent success when it comes to M&A.

A constant question across all industries, as far as M&As are concerned, pertains to the factors that differentiate organizations with successful histories. The magic ingredient in the success of these companies is their Corporate Strategy that utilizes Capabilities as the source for inorganic Growth. Capabilities-driven M&A have managed to raise shareholder value for the acquirer despite the tough years since the economic crisis of the 2000s. The majority of other inorganic Growth attempts produced a loss of value.

Companies employing the Capabilities-driven Strategy were recompensed with deals that had a Compound Annual Growth Rate (CAGR) average of 12 percentage points greater in shareholder return compared to M&A deals by other acquirers in that very industry and region.

Particular industries, for instance Information Technology and Retail, demonstrated a bigger effect. However, all industries displayed a steady, noticeable, Capabilities Premium in M&A. Capabilities-driven Strategy is exceptionally beneficial in M&A transactions where, frequently, time window is narrow and the risks elevated.

Capabilities Systems are defined as 3 to 6 reciprocally strengthening, distinguished Capabilities that are structured to hold up and drive Organizational Strategy, integrating people, processes, and technologies to create something of value for customers.

Setting apart likely M&A success factors is accomplished more easily by separating successful deals by their declared Intent consequently, capturing the dominant view regarding purpose of each deal.

Intent can be classified into 5 categories: Capability Access Deals, Product and Category Adjacency Deals, Geographic Adjacency Deals, Consolidation Deals, and Diversification Deals.

There is a lot of talk about Fit during M&A discussions. Fit does not mean introducing an ostensibly linked product or service, plugging a gap in a category, or moving in a new geography—such sorts of acquisitions are frequently unsuccessful.

Fit relates to unity, the benefit that ensues when Capabilities of a company fit mutually into a system, lining up to its market position, and employed to its complete array of products and services.

Deals when cross-categorized by their Capabilities System Fit, fall into following 3 categories:

Let us delve a little deeper into the 3 categories.

Enhancement deals enable the acquiring company to include new Capabilities so as to close gaps in its present Capabilities System or counter an alteration in its market.

Nearly 2/3rd of the deals studied—in a 2011 study spanning 8 sectors—used Capabilities to good effect, either by way of Enhancement or Leverage.

Leverage deals are where the acquirer makes use of prevailing Capabilities System in their company to handle incoming products and services, customarily augmenting the acquired company’s performance.

Leverage deal are frequently low-risk deals that may not require the acquirer to alter anything concerning its inhouse Capabilities System to make it work.

Limited-fit deals are deals where the purchasing company generally ignores Capabilities. Normally such deals provide a purchaser with product or service that need new Capabilities.

Interested in learning more about Capabilities-driven M&A? You can download an editable PowerPoint on Capabilities-driven M&A here on the Flevy documents marketplace.

Gain the knowledge and develop the expertise to become an expert in Post-merger Integration (PMI). Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

M&A is an extremely common strategy for growth. M&A transactions always look great on paper. This is why the buyer typically pays a 10-35% premium over the of the target company’s market value.

However, when it comes time for the Post-merger Integration (PMI), are we really able to capture the expected value? Studies show only 20% of organizations capture projected revenue synergies and only 40% capture cost synergies. Not to mention, the PMI process is typically very painful, drawn out, and politically charged, often resulting in the loss of key personnel.

Learn about our Post-merger Integration (PMI) Best Practice Frameworks here.

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd

Financial crisis, adverse supply shock, technological disruption, or natural hazards and disasters significantly affect global businesses. Recessions caused by these global incidents and problems have serious outcomes on commodity prices, stock markets, economies, and even countries.

Financial crisis, adverse supply shock, technological disruption, or natural hazards and disasters significantly affect global businesses. Recessions caused by these global incidents and problems have serious outcomes on commodity prices, stock markets, economies, and even countries.

A Downturn can be described as a contracted business cycle with a significant decline in economic activity across markets with subsequent drop in spending, GDP, real income, employment, and manufacturing. Downturns cause inflation, decline in sales revenues and profits, and cutbacks on R&D and other crucial expenditures. The scenario challenges businesses because of tightening credit conditions, slower demand, layoffs, and general insecurity.

The organizational readiness to manage and curtail the adverse effects of downturns is the top agenda for the senior executives. However, the uncertain nature of an economic crisis often triggers rash responses or even inaction.

Any haphazard responses or inaction can make recovery of an organization from a downturn costly later on. Downturn management necessitate a calculated approach to confront the uncertainties, anxiety among the employees, and to unlock opportunities out of such crisis. An effective approach to deal with the downturn crisis encompasses 2 key phases:

Let’s dive deeper into the 2 phases.

This phase entails a series of actions to safeguard the organization from downturns and maintain the liquidity required to sustain the period of uncertainty. Leading organizations take downturns as an opportunity to deploy planned yet urgent, high-priority interventions to maintain standard functioning of the enterprise. They carry out careful analysis to appraise and curtail the risks of exposure. Key steps required to stabilize the organization during a downturn include:

This step demands a methodical assessment of risks associated with exposure. This necessitates evaluating various scenarios and their impact on the organization as well as on the industry. The step helps in ascertaining the units that are more susceptible to downturn risks and warrants prompt action. The analysis of various scenario assists in highlighting and communicating the rationale—for interventions required to manage the downturn—to the people across the organization.

Specifically, the step involves initiating 3 fundamental actions:

Once the executives have determined the impact of downturn exposure on their business, it’s time to work on reducing the exposure from crisis risks. An understanding of the effects of a downturn exposure on the business helps the senior executives discern the most appropriate method to subsist and make the most of their organizational performance during the downturn.

In order to subsist and minimize downturn exposure risks senior leadership needs to maintain enough liquidity and access to capital to make sound investments in future, keeping a check on cash flows by generating weekly / monthly cash reports, cutting down or delaying discretionary spending, carrying out interventions to improve fundamental business, improve business processes, and maintain the organization’s market value and positive outlook for the investors.

Specifically, the executives have to work on achieving these 3 objectives:

The Capitalize phase focuses on growing the business and making the most of the economic situation. Leading organizations prudently manage downturns with greater diligence and immediate, well-thought-out response. Downturns do not preclude executives from investing in critical interventions. Most investments take time to fruition and postponing crucial investments may put an organization on the back foot when economic conditions normalize.

To capitalize on these hard times, senior executives need to carefully think about and prioritize the various investment options and endeavors critical for improving productivity and revenue, consolidate the business through mergers or acquisitions, hold back spending on projects with unclear results, shelve the endeavors that do not have a key role in future success, and invest in developing their people.

Specifically, they should chart out 3 key actions to take advantage of the crises and emerge rejuvenated after these tough times:

Interested in learning more about the phases and key actions required to manage Downturns? You can download an editable PowerPoint on Downturn Management and Transformation here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Many large corporations depend on M&A for growth and executives can boost the value that deals create. But poorly executed M&A can saddle  investors with weak returns on capital for details. In fact, the margin between success and failure is slim.

investors with weak returns on capital for details. In fact, the margin between success and failure is slim.

Many Boards are reluctant to cross the line between governance and management. The level of engagement is often outside the comfort zone for some executives and directors. As such, they miss opportunities to help senior executives win at M&A.

There is a need to modernize the Board’s role in M&A. Modernizing the role of the Board in M&A can result in the alignment of the Board and management on the need for bolder transactions with more upside potential. Further, this is essential in achieving a competitive advantage.

There are 3 core opportunities for the Board to play an impactful role in M&A.

The 3 core opportunities can promote greater Board engagement. When this happens, discrete deals can be converted into ongoing deal processes and dialogues that can deliver greater value from M&A.

The potential of the 3 Core Opportunities to embolden the role of the Board in M&A is great. Organizations just need to have a good understanding of each core opportunity and the underlying key areas or dimensions of each key area. Let us take a look at the 1st Core Opportunity: Potential for Value Creation.

The Potential for Value Creation has 3 critical key areas that can challenge that lead opportunistic transaction to succeed. One critical key area is Strategic Fit.

Strategic Fit is key to determining why a company is a better owner than competing buyers. Deals driven by strategy succeed more often when they are part of a stream of similar transactions that support that strategy. This is a key element in Strategy Development.

How can we enhance the role of the Board relative to this key area? The Board can play a vital role in clarifying the relationship between a potential transaction and strategic planning. They are also in the best position to define how the deal will support organic-growth efforts in target markets and provide complementary sources of value creation.

The other key areas under the Potential for Value Creation are Financial Statements and Risks vs. Rewards. The Financial Statements is a key area that can correct the Board’s tendency to put emphasis on price-to-earnings multiples which can be limiting. The Risks vs. Rewards, on the other hand, is a key area that challenges the Board to acknowledge uncertainties in pro forma.

The other 2 Core Opportunities also have their own essential points or dimensions the Board must focus on. Only then can these core opportunities be of the maximum potential of modernizing the Board’s role in M&A and gaining the greatest value.

Interested in gaining more understanding of achieving Board Excellence through M&A? You can learn more and download an editable PowerPoint about Board Excellence: M&A here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

The pressure on Boards and Directors to raise their game has remained acute. A survey of more than 770 directors from public and private  companies across the industries around the world suggested that some are responding more energetically than others.

companies across the industries around the world suggested that some are responding more energetically than others.

There is a dramatic difference between how directors allocate their time among boardroom activities and the effectiveness of the Boards. One in four directors assessed their impact as moderate or lower, while others reported as having a high impact across Board functions.

Today, the call to become more forward-looking and achieving Board Excellence is further highlighted. This is further emphasized when the Board and Management are pressured to find the best answers to global business concerns and issues. In Strategy Development, this becomes invaluable. It does not only lead to clearer strategies but also the creation of alignment essential in making bolder moves.

While these are essential, there is a need to raise the quality of engagement on strategy between the Board and Management for each group to achieve smarter options. This is possible only if organizations have high impact, strategic Boards in place.

High impact, strategic Boards have a greater impact as they move beyond the basics and face increasing challenges.

Business is fast-changing and rapidly transforming. The global economy is increasingly pushing businesses, as well as the Board to face a gamut of challenges.

What are the 2 main challenges facing Boards today?

First is Time Commitment. Working at a high level takes discipline – and time. In fact, the greater time commitment is expected on high impact activities. The Board often have 6 to 8 meetings a year. As a result, they are often hard-pressed to get beyond the compliance-related topics to secure the breathing space needed for developing a strategy.

Often, it is the very high impact Directors who invest more time compared to moderate or lower average Directors.

Who are your very high impact Directors? They are those spend a total of 40 days a year working for the Board compared to 19 days of low impact Directors. An extra 8 workdays a year is invested in strategy and an extra 3 workdays a year are spent on Performance Management, M&A, Organizational Health, and Risk Management.

High impact Directors who believe that their activities have greater impact spend significantly more time on these activities compared to low impact Boards.

Second is Strategy Understanding. Why is Strategy Understanding a challenge for the Board? Limited understanding of the organization’s strategy can result in the Board’s limited engagement with the organization. Based on the survey made, only 21% of the Directors have a complete understanding of the current strategy. Often, Board members have a better understanding of the company’s financial position rather than its risks or industry dynamics.

If we look at high impact Directors, they invest more time in dealing with strategic issues. In fact, they invest 8 extra workdays a year on Strategic Planning and discussing strategy compared to low impact Directors. High impact Directors center on Strategy Focus Areas which can, in turn, spur high-quality engagement from the Board on strategy development. The quality of Board engagement on strategy is enhanced, both when the engagement is deep and during the regular course of business.

The Board just needs to focus on 3 areas of discussion for the Board to enhance Strategy Development. One of them is Industry and Competitive Dynamics.

Interested in gaining more understanding of Board Excellence via High Impact, Strategic Boards? You can learn more and download an editable PowerPoint about Board Excellence: High Impact, Strategic Boards here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

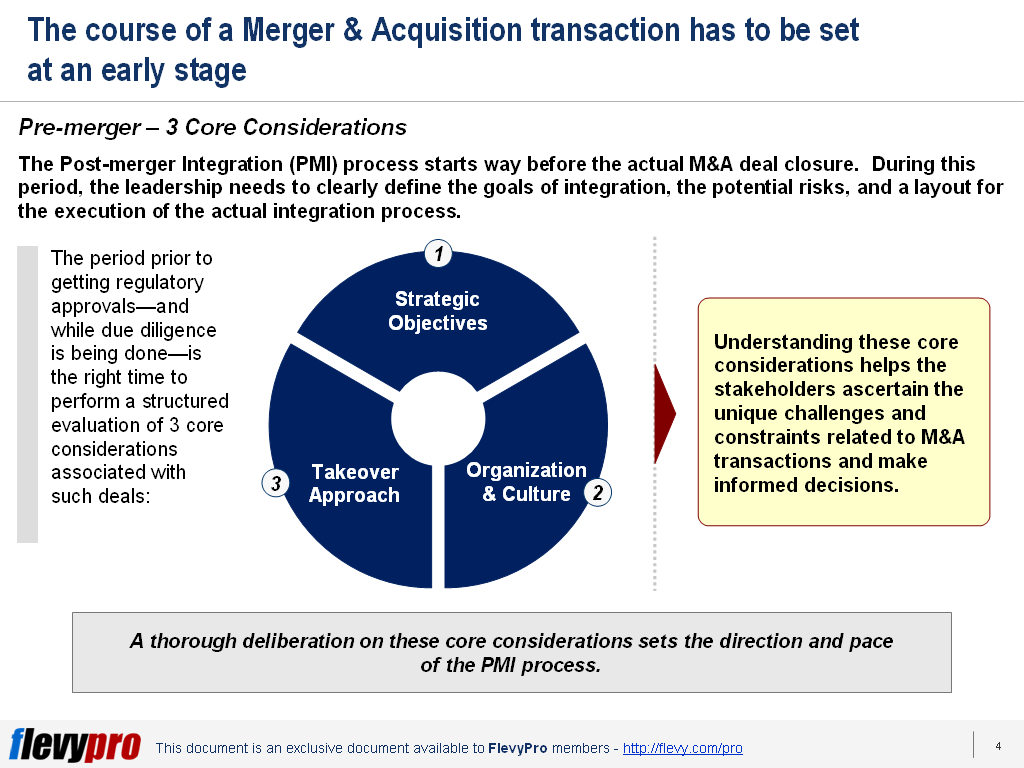

The course of an M&A transaction has to be set at an early stage, way before the actual deal closure. The period prior to the deal approval by the regulatory authorities and while due diligence is being done is most critical, and should be utilized by the leadership to clearly define the goals of integration, the potential risks, and a layout for the execution of the actual integration process. It is the right time to perform a structured evaluation of 3 core pre-merger considerations associated with such deals, i.e.:

Understanding these PMI Pre-merger considerations helps the stakeholders ascertain the unique challenges and constraints related to M&A transactions and make informed decisions. These considerations assist in developing a systematic approach to undertaking a Post-merger Integration (PMI) — which is devoid of any “gut decisions,” and ensures realization of synergies and value. These considerations set the direction and pace of the post-merger integration process.

Now, let’s discuss the 3 core considerations in detail.

Organizations undertake Mergers and Acquisitions as a way to accelerate their growth rather than growing organically. The foremost core consideration associated with an M&A transaction is the strategic objectives that the organizational leadership wants to achieve out of it.

M&A deals take place to fulfill one or more of these 5 strategic objectives:

The PMI approach needs to be tailored in accordance with the desired strategic objectives of the deal.

The senior management should be mindful of the significance of organizational and cultural differences in the two organizations that often become barriers to M&A deals. Small companies, typically, have an entrepreneurial outlook and culture where there aren’t any formal structure and the owner controls (and relays) all the information and decision making. Whereas, large corporations typically have formal structures and well-defined procedures.

A takeover of a small firm by a large entity is bound to stir criticism and disagreement. M&A process often faces long delays between the offer, deal signing, and closing — due to antitrust reviews or management’s indecisiveness — triggering suspicion among people. This should be mitigated during the PMI process by orienting the people of the small firm with the new culture and giving them time to transition effectively.

For M&A deals to be effective, leadership needs to carefully evaluate the behavioral elements of the organizational culture and contemplate the overriding principles guiding a company.

Integrating the operations of two companies proves to be a much more difficult task in practice than it seems theoretically. Organizations have the option of selecting the takeover approach most suitable for them from the following 4 methodologies — based on their organizational structures, people, management, processes, and culture:

Interesting in learning more about the takeover approach and the pre-merger considerations in detail? You can download an editable PowerPoint on Post-merger Integration: Pre-merger Considerations here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—Mergers and Acquisitions. However, only a few M&As achieve their desired revenue objectives.

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—Mergers and Acquisitions. However, only a few M&As achieve their desired revenue objectives.

Revenue Synergies are a decisive factor in closing such deals. However, identifying precisely where these Revenue Synergies lie and then capturing them isn’t as easy as it sounds.

A McKinsey study comprising of 200 M&A executives from 10 different sectors revealed that all the respective organizations of the respondents remained short of achieving their Revenue Synergy targets (~23% short of the target on average). Securing Revenue Synergies is a long-term game. The companies that succeed in securing Revenue Synergies achieve the target in or around 5 years.

Leaders aspiring to achieve Revenue Synergies should first clarify the objectives from and the schedule of the revenue synergies, lay out the organizational priorities and go-to-market strategies, remove obstacles from realizing value, and gain across the board readiness and commitment for the initiative. Organizations that are most successful in securing revenue synergies pay close attention to these 7 guiding principles during the Post-merger Integration process:

These 7 guiding principles to capturing Revenue Synergies are critical for effective integration of two firms after a merger and unlocking potential benefits from the deal. Let’s discuss the first 3 principles in detail now.

The inability of the leadership of the acquiring company to spot major sources of revenue that integration brings in results in losing significant pools of opportunity and failure of M&As. Realizing Revenue Synergies demands a thorough methodology to ascertain and qualify revenue prospects along markets and channels, Go-to-Market Strategies, and developing commercial capabilities. This entails:

Organizations that accomplish their Revenue Synergy objectives guarantee that their top management and employees commit themselves fully to the initiative from the onset. They identify potential value pockets from the integration, examine the assumptions about securing value, and get them endorsed by the senior management and front-line staff. The potential Revenue Strategies are regularly evaluated by inter-departmental experts.

Accurate estimation of Revenue Synergies demands top-level estimates—assumptions on market share gain, revenue enhancement, or improved penetration—alongside comprehensive bottom-up customer insights, and evaluation of customer relationships. Other important elements to consider include analyzing the offerings being offered to customers, discerning other potential products and services required by the customers, and assessing the ability of the sales team and brands in terms of the potential they offer to the clients.

Interested in learning more about the other guiding principles of securing PMI revenue synergies? You can download an editable PowerPoint on Post-merger Integration (PMI): Securing Revenue Synergies here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Error: Twitter did not respond. Please wait a few minutes and refresh this page.