Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Learn the methodologies, frameworks, and tricks used by Management Consultants to create executive presentations in the business world.

Become a PowerPoint Guru by Dave Tracy

Become a PowerPoint Guru by Dave Tracy

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

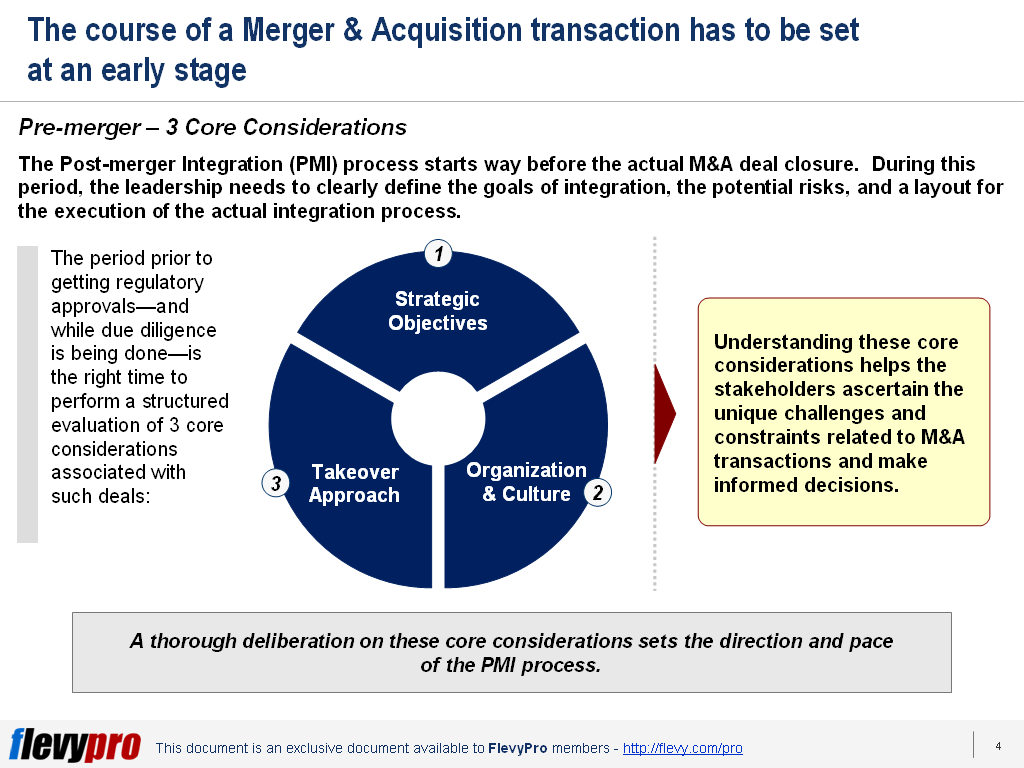

The course of an M&A transaction has to be set at an early stage, way before the actual deal closure. The period prior to the deal approval by the regulatory authorities and while due diligence is being done is most critical, and should be utilized by the leadership to clearly define the goals of integration, the potential risks, and a layout for the execution of the actual integration process. It is the right time to perform a structured evaluation of 3 core pre-merger considerations associated with such deals, i.e.:

Understanding these PMI Pre-merger considerations helps the stakeholders ascertain the unique challenges and constraints related to M&A transactions and make informed decisions. These considerations assist in developing a systematic approach to undertaking a Post-merger Integration (PMI) — which is devoid of any “gut decisions,” and ensures realization of synergies and value. These considerations set the direction and pace of the post-merger integration process.

Now, let’s discuss the 3 core considerations in detail.

Organizations undertake Mergers and Acquisitions as a way to accelerate their growth rather than growing organically. The foremost core consideration associated with an M&A transaction is the strategic objectives that the organizational leadership wants to achieve out of it.

M&A deals take place to fulfill one or more of these 5 strategic objectives:

The PMI approach needs to be tailored in accordance with the desired strategic objectives of the deal.

The senior management should be mindful of the significance of organizational and cultural differences in the two organizations that often become barriers to M&A deals. Small companies, typically, have an entrepreneurial outlook and culture where there aren’t any formal structure and the owner controls (and relays) all the information and decision making. Whereas, large corporations typically have formal structures and well-defined procedures.

A takeover of a small firm by a large entity is bound to stir criticism and disagreement. M&A process often faces long delays between the offer, deal signing, and closing — due to antitrust reviews or management’s indecisiveness — triggering suspicion among people. This should be mitigated during the PMI process by orienting the people of the small firm with the new culture and giving them time to transition effectively.

For M&A deals to be effective, leadership needs to carefully evaluate the behavioral elements of the organizational culture and contemplate the overriding principles guiding a company.

Integrating the operations of two companies proves to be a much more difficult task in practice than it seems theoretically. Organizations have the option of selecting the takeover approach most suitable for them from the following 4 methodologies — based on their organizational structures, people, management, processes, and culture:

Interesting in learning more about the takeover approach and the pre-merger considerations in detail? You can download an editable PowerPoint on Post-merger Integration: Pre-merger Considerations here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Mergers and Acquisitions (M&A) are unique and complex endeavors. These initiatives demand tailored solutions keeping in view the varying environments, ways of doing business, culture of the two combining organizations, and internal and external forces influencing the deal.

Mergers and Acquisitions (M&A) are unique and complex endeavors. These initiatives demand tailored solutions keeping in view the varying environments, ways of doing business, culture of the two combining organizations, and internal and external forces influencing the deal.

These transactions necessitate making 8 important decisions based on thorough deliberation and analysis of all relevant factors well before the integration process. These fundamental decisions and relevant factors form the 8 decision levers of Post-merger Integration (PMI). These 8 decision levers of PMI are essential for devising an optimal integration approach and, subsequently, the success of an M&A initiative:

These decision considerations facilitate Post-merger Integration across all industries and organizations of various sizes. Let’s discuss the first 3 decision levers in detail now.

The foremost element of a PMI is deciding on the type of synergy to be achieved through integration. The question is to either focus on achieving cost reduction or growth synergies. If cost cutting is the objective of an M&A then the leadership of the combined organization needs to outline potential costing saving opportunities across the board. This should be followed by robust communication strategy to convey the implications of the M&A program. However, if the management’s objective is to unlock growth synergies from the acquisition, then the integration is to be treated as a strategic endeavor—e.g., understanding the customer needs, evaluating market potential, generating innovative business ideas, and developing execution plans.

The 2nd lever demands from the senior leadership to determine the pace most appropriate for the integration of their newly combined enterprise—i.e., to choose between a fast track and a steadier integration approach. A majority of executives believe that PMI should be executed as quickly as possible, so that upon completion of the initiative they could divert their center of attention back to business operations. This approach, however, involves decisions that aren’t backed by detailed analysis of facts and data, and is likely to face increased risks and uncertainties. On the other hand, a slower pace of integration is beneficial in case of a friendly takeover or expansion in a new domain. A steadier pace of integration works well to reduce any apprehensions, cynicism, bottlenecks, and risks due to oversight.

PMI necessitates gauging the appropriate degree of integration beneficial for the organization—i.e., choosing between extensive across the board versus partial integration. An absolute focus on cost synergies warrants an extensive degree of integration across all departments and geographies. This puts extra pressure on teams in terms of work and risks dwindling enterprise focus on the customer. Committing more resources and setting the priorities right aids in offsetting the risks associated with an extensive degree of integration. A partial integration, on the other hand, is simpler, less controversial, and predominantly warrants consolidation of sales or alignment of mission-critical processes. This typically works well in takeovers requiring new products acquisition or addition of new customer segments.

Interested in learning more about the other 5 decision levers of PMI? You can download an editable PowerPoint on Post-merger Integration (PMI): 8 Levers here on the Flevy documents marketplace.

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Error: Twitter did not respond. Please wait a few minutes and refresh this page.