Changing the behaviors of people is the foremost issue with every transformation initiative.

Changing the behaviors of people is the foremost issue with every transformation initiative.

Nudge theory is a novel Change Management model that underscores the importance of understanding the way people think, act, and decide. The model assists in encouraging human imagination and decision making, and transforming negative behaviors and influences on people. The approach helps understand and change human behavior, by analyzing, improving, designing, and offering free choices for people, so that their decisions are more likely to produce helpful outcomes for the others and society in general.

Nudge theory helps reform existing (often extremely unhealthy) choices and influences on people. The theory is quite effective in curtailing resistance and conflict resulting from using autocratic ways to change human behavior. The model promotes indirect encouragement and enablement—by designing choices which encourage positive helpful decisions—and avoids direct enforcement. For instance, playing a ‘room-tidying’ game with a child rather than instructing her/him to tidy the room; improving the availability and visibility of litter bins rather than erecting signs with a warning of fines.

Organizations are increasingly using behavioral economics to optimize their employee and client behavior and well-being. Nudge units or behavioral science teams are being set up in the public and corporate sectors to influence people to address pressing issues. For instance, to increase customer retention by changing the language of support center staff to motivate customers to consider long-term benefits of a product; or to make employees to follow safety procedures by placing posters of watching eyes to remind them of the criticality of the measure.

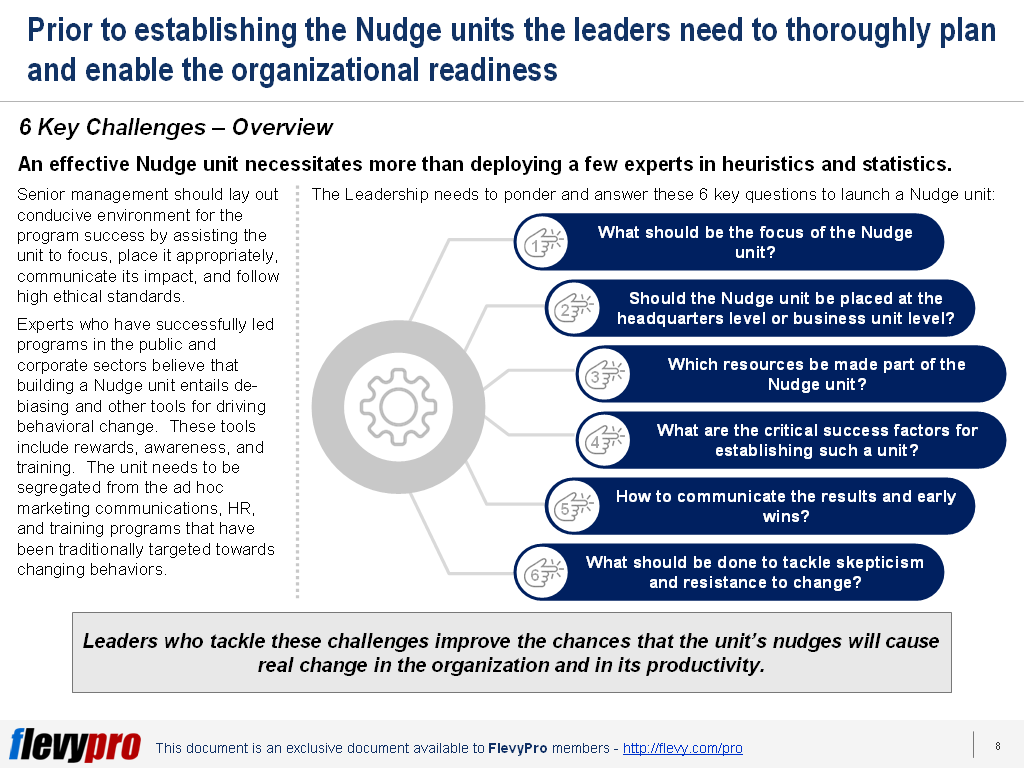

An effective Nudge initiative necessitates much more than deploying a few experts in heuristics and statistics. The senior leadership should lay out a conducive environment for successful behavioral transformation. This entails assisting the Nudge unit to focus, place it appropriately, create awareness, train and de-bias people, implement effective rewards, and follow high ethical standards.

The leadership needs to think about and prepare to tackle 6 key challenges Nudge units face when implementing effective behavioral transformation initiatives:

- What should be the focus of the Nudge unit?

- Should the Nudge unit be placed at the headquarters or at the business unit level?

- Which resources be made part of the Nudge unit?

- What are the critical success factors to consider for the unit?

- How to communicate the results and early wins?

- What should be done to tackle skepticism and resistance to change?

Let’s, now, dive deeper into the first 3 key challenges.

What should be the focus of the Nudge unit?

The foremost action in creating a Nudge team is to clearly spell out the value proposition for the unit. The leadership needs to define the purpose of creating a Nudge unit. They need to clearly outline whether the Nudge team will focus on employees, on customers, or on both. For instance, the purpose of its creation could be to deal with workforce motivation, to make better decisions in boardrooms, to increase the internal capabilities, or to improve the behavior of employees. The focus on customer issues, for example, entails encouraging better pension provision, inculcating behavioral science into the marketing mix, or to analyze the experiences of customers and employees—e.g., in-store service initiatives, digital operations, and HR processes.

Should the Nudge unit be placed at the headquarters or at the business unit level?

The second challenge is to decide where to deploy the Nudge unit. The placement of the Nudge unit depends on the strategic purpose of creating the unit. At some companies, it is housed centrally within the corporate headquarters as a global Nudge operations center; a few have accommodated the unit within the R&D or marketing department; some have benefited by moving the unit away from the corporate center so as to be closer to products and services; whereas other practitioners believe that the customer-focused behavioral science team should sit within the product management domain.

Regardless of where the Nudge unit resides, its flexibility and assimilation with other methods of behavioral change—e.g., cognitive neuroscience, social psychology, and personality-trait science—are critical.

Which resources be made part of the Nudge unit?

Another critical element for the success of the Nudge unit is hiring and deployment of right resources. At the commencement of the program when key capabilities are typically not available in-house, most organizations hire people from the outside for their Nudge units. A few companies have recruited solely from the in-house due to the criticality of institutional knowledge and the long learning curve required to acquire it, whereas some have recruited across different geographies. On average, the unit comprises of 3 to 8 members, however, larger organizations can have more people scattered globally.

The ideal composition of the Nudge team is to include behavioral scientists and specialists in psychology, marketing, and advanced data analytics. The team should include people with the right attitude and abilities—e.g., curiosity, can-do attitude, problem solving, entrepreneurial mindset, ownership, and communication skills.

Interested in learning more about the Nudge Theory? You can download an editable PowerPoint on Nudge Theory: Key Challenges here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

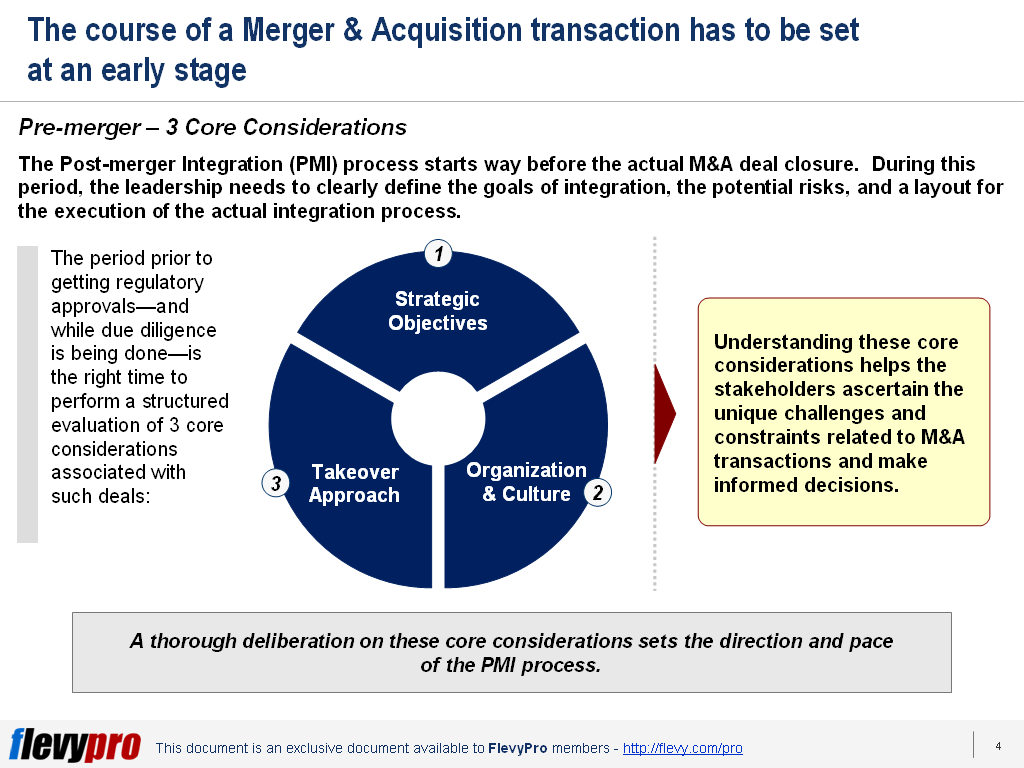

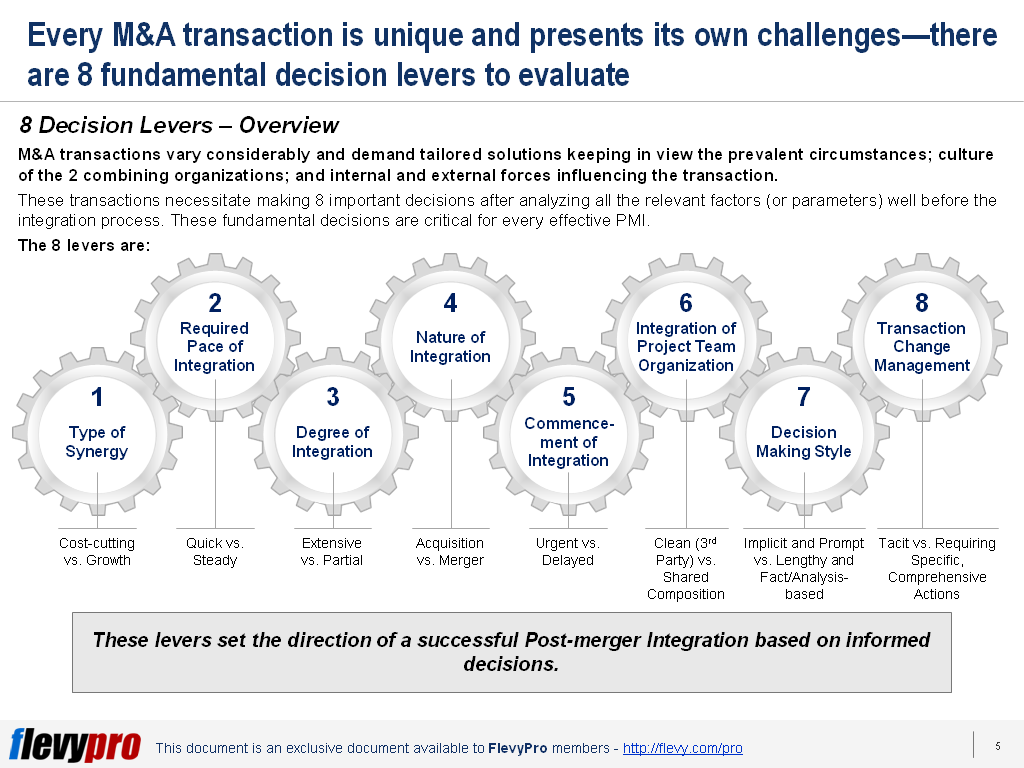

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Takeovers can turnaround companies in a short period of time, but there is a significant degree of risk to be anticipated and mitigated prior to undertaking such transactions. Lack of careful deliberation of the potential risks, insufficient planning, weak execution, and lack of focus on Post-merger Integration are the major reasons why many Merger & Acquisition deals fail to achieve their desired goals.

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—

Stiff market competition, expansion into new territories, product portfolio extension, and gaining new capabilities are the prime reasons why more and more organizations are seriously looking into the prospects of—and carrying out—

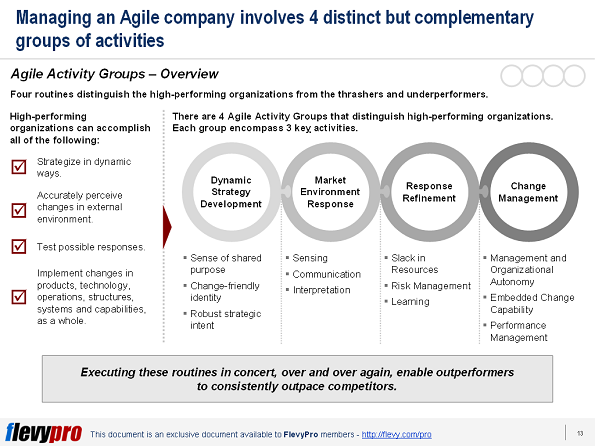

difficult when the competitive environment changes. Likewise, high performance as measured by shareholder returns is impossible to sustain over a long period of time. No company consistently beats the market.

difficult when the competitive environment changes. Likewise, high performance as measured by shareholder returns is impossible to sustain over a long period of time. No company consistently beats the market.

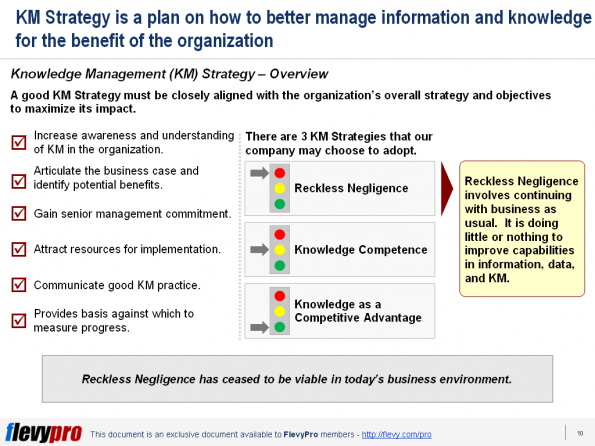

importance. The struggle between competing firms has moved from tangible resources to intangible resources where knowledge and the ability to use knowledge have crucial roles.

importance. The struggle between competing firms has moved from tangible resources to intangible resources where knowledge and the ability to use knowledge have crucial roles.

incoherence between a company’s product and its overall

incoherence between a company’s product and its overall

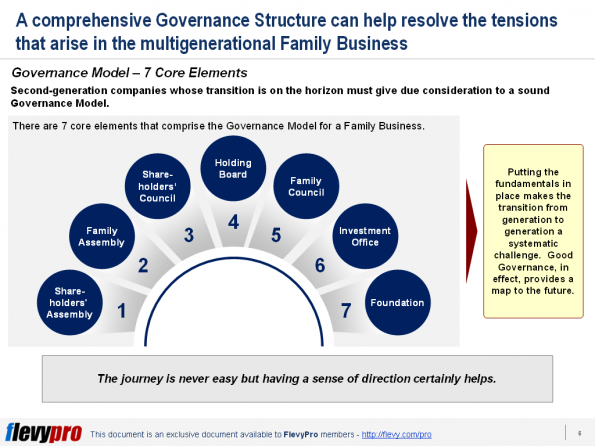

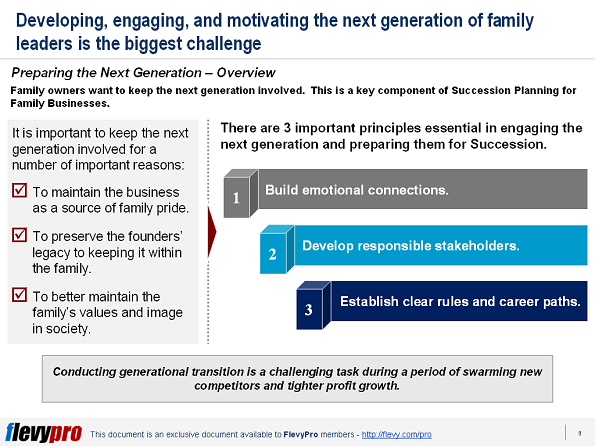

global economics. Propelled by fast growth in the emerging world, the share of family businesses in the global Fortune 500 grew from 15% in 2005 to 19% in 2013. Five years ago, founders or their families owned 60% of emerging-market companies with sales of $1 billion or more. By 2025, an additional 4,000 companies may join the list. Family-owned businesses would represent 40% of the world’s large enterprise.

global economics. Propelled by fast growth in the emerging world, the share of family businesses in the global Fortune 500 grew from 15% in 2005 to 19% in 2013. Five years ago, founders or their families owned 60% of emerging-market companies with sales of $1 billion or more. By 2025, an additional 4,000 companies may join the list. Family-owned businesses would represent 40% of the world’s large enterprise.

generation. Establishing a set of Councils and Boards is essential in addressing critical transition issues. With a Governance Model,

generation. Establishing a set of Councils and Boards is essential in addressing critical transition issues. With a Governance Model,